When you think of poverty, you probably think of an extreme lack of income, but research has found that the lack of assets is much more prevalent and hindering of economic mobility. The economic upheaval caused by the COVID-19 pandemic highlighted the fragility of the average American’s personal finances. Most people are working paycheck to paycheck, and this is truest for households that have low incomes.

The ability to acquire assets is what determines long-term stability and security, and the opportunity to build intergenerational wealth. According to a June 2021 report by the Brookings Institute on the Black-White gap in multigenerational poverty, more than one in five Black Americans (21.3%) are in the third generation of family poverty compared to just 1.3% of whites who are experiencing the same. The racial disparities continue to shock, as they found that 59% of 30-something aged Black Americans have a grandparent who was poor compared to just nine percent of whites.

At BRHP, our focus is on providing housing choice and mobility to create better life outcomes for families in our program, but we know that in most cases, that is not enough to create long-term economic mobility. While our program has been very successful in empowering families to transition to quality housing in higher opportunity areas, and research has shown the benefits that will accrue for the children in these families, we know that many adults in our households remain stagnant with their income growth and are in search of ways to grow both their income and assets. The other reality is that we have over 14,000 households on our program waitlist and due to federal funding constraints, we have needed to identify ways to serve more families with young children. Our newly announced asset building program, GAIN (or Growing Assets and Income), is an intentional strategy to create a pathway for financial, career, homeownership and educational success for our clients.

On June 24, as a part of our “BRHP in Conversation” series, we sat down with Markita Morris-Louis, chief strategy officer of Compass Working Capital, to discuss asset building as a tool for lifting families out of poverty. Our talk with Markita was inspired by the recent funding and development of our GAIN program. We sought to better understand Compass’s acclaimed asset building model and Family Self Sufficiency (FSS) programs as a whole and their impact on families. We also wanted to share this information with other public housing authorities and others working in and supporting housing equity as a viable and time-tested tool for addressing poverty. Our discussion began with an introduction to FSS through a video testimonial from a woman named Lidia, who was able to purchase a home she had been renting for 8 years through the Compass Working Capital’s FSS program.

“We take an asset development approach to poverty alleviation because we know that assets are a stronger predictor of family stability than income,” said Markita. “In fact, it tells a fuller story about those who experience financial challenge in our country.”

Oftentimes, financial assistance programs address a family’s immediate income needs, but do not help the family to build assets. Markita mentioned that these families are often penalized for having assets while receiving such benefits and are therefore left asset poor, which she describes as “not having savings or not being able to access at least 3 months of savings to meet your basic needs and to cover living expenses for 3 months.” This is a unique benefit of FSS programs – the ability to receive federally subsidized housing while also being able to save and grow money.

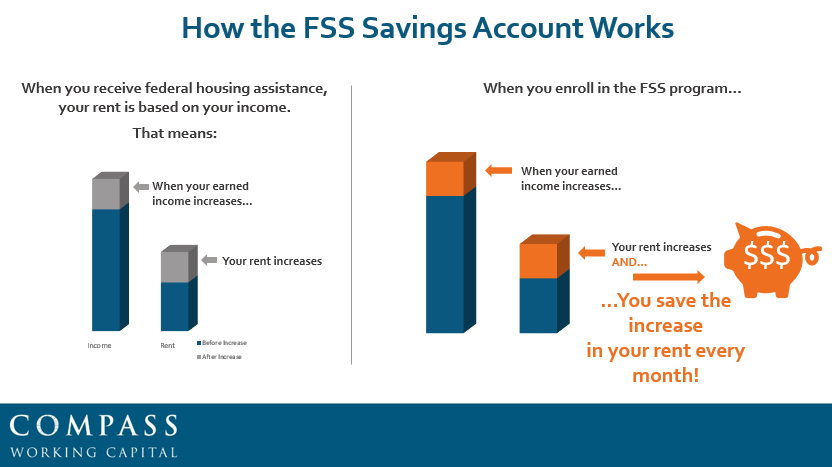

The graphic above explains the FSS savings process. Many families who receive federal housing assistance feel that they take one step forward and one step back when they begin to earn more income because their rent also increases (per HUD guidelines). The FSS program addresses this by allowing the participant to save an increase in their rent resulting from increases in earned income every month in an escrow savings account that accumulates over time. This allows the participant to use the accumulated funds to achieve their financial goals, whether it be establishing emergency savings funds, education, entrepreneurship, or even homeownership. There is no other anti-poverty program like FSS.

“They dream. They get to dream and set goals and work really hard to achieve those goals and actually have the resources to execute on those goals,” said Markita.

Nationally, FSS serves approximately 70,000 families with three out of four families being Black or Latinx. Compass’s clients are majority women at 91% and 85% are women of color. While touting FSS as an effective tool for addressing racial and gender wealth gaps, Markita emphasized that the program is filling in the gaps for what the U.S. needs to provide in the forms of reparations at scale, redress of centuries old racial and economic injustice, and accessibility to baby bonds and guaranteed income. The FSS program has been active for 30 years and has received bipartisan support through multiple political administrations.

With funding support from the Abell Foundation, BRHP looks forward to taking up the mantle of asset building along with Compass to address the lack of wealth-building opportunities for families with low incomes, and we look forward to making economic mobility the norm for more families here in the Baltimore region. Catch the replay of the discussion below and learn more about the qualities of a strong FSS program and how you can start your own to support your community.